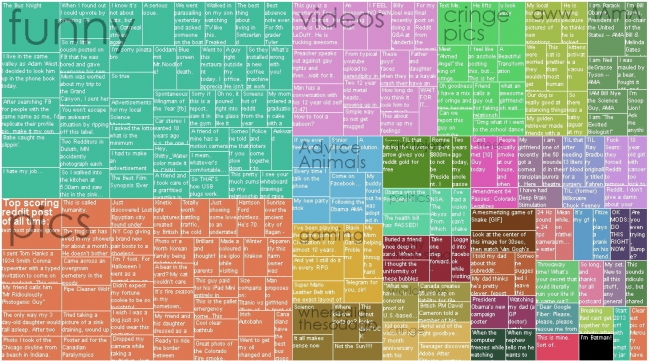

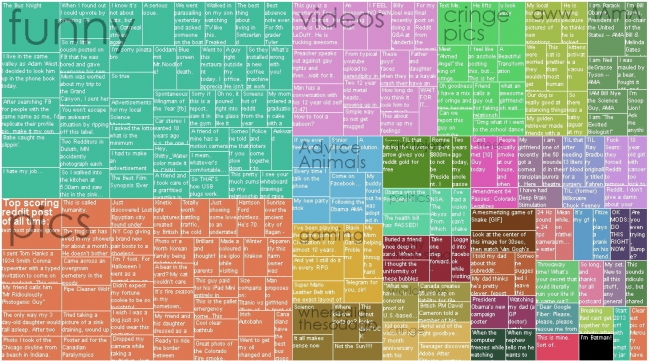

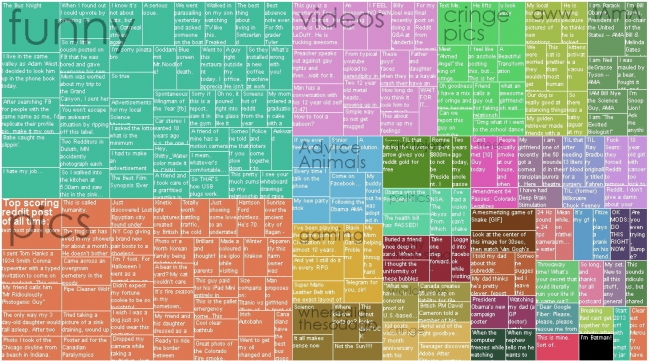

A chart of the top 200 posts on Reddit

Monday, December 2, 2013

Computer science student James Trimble has put together this interactive visualization of the 200 all-time top posts on Reddit, by the most important subreddits.

via

via

If you liked this post, you can

subscribe to the Blame It On The Voices RSS feed and get your regular fix

If you liked this post, you can

subscribe to the Blame It On The Voices RSS feed and get your regular fix

33 comentarii:

This chart of the top 200 Reddit posts is fascinating because it really shows what grabs collective attention online. I noticed a mix of humor, personal stories, and big news moments. It’s funny how topics like Umrah Visa updates could someday trend if timing and community interest align.

Cool breakdown of Reddit’s top 200 posts! It’s wild how memes and personal stories dominate the chart. Honestly, if a travel agent agency tried posting quirky behind-the-scenes stuff, it could easily climb too. Shows how authentic, entertaining content really grabs attention across every niche.

Pretty cool breakdown of the top 200 Reddit posts. It’s interesting how diverse content trends online, from memes to deep discussions. Seeing this chart reminds me of how I once searched trip guides during my nathia gali tour and ended up finding useful threads there too.

This chart of the top 200 Reddit posts is a goldmine for spotting trends. I noticed discussions around streaming, especially mentions of Iptv Canada popping up multiple times. It’s interesting to see how popular content like that spreads fast, showing exactly what Reddit users are buzzing about.

This chart of the top 200 posts on Reddit is fascinating—seeing what trends and topics really engage people. Some posts even touch on streaming services like Iptv Canada, which shows its growing interest online. Overall, it’s a solid snapshot of Reddit activity and popular discussions.

If you’ve been avoiding exploring financing options out of fear of lowering your credit score, Virginia Mortgage Prequalify Without Credit Pull provides the perfect solution. It uses a soft inquiry to assess your eligibility without leaving a mark on your report. You get accurate insights into potential opportunities without any risk to your score. This method is ideal for anyone who wants to plan ahead while maintaining flexibility. By eliminating the stress of a hard inquiry, it gives you the freedom to evaluate scenarios at your own pace and move forward when you’re ready.

In competitive housing markets, being prepared makes all the difference. With No Touch Mortgage Preapproval Richmond Virginia, you can streamline the preapproval process and gain an edge over other buyers. The ability to complete everything digitally gives you more flexibility and control, while also helping you act quickly when opportunities arise. It’s a smarter, faster way to secure your place in the market.

Choosing the right financial partner is one of the most important decisions when planning a new chapter in Richmond. With caliber home loans richmond va, clients benefit from a team that prioritizes clarity and personalized attention. Advisors work to fully understand each client’s goals before recommending tailored solutions that align with their financial future. This hands-on approach builds trust while ensuring decisions are made confidently. In an ever-changing market, having professionals who focus on long-term success makes all the difference for residents seeking stability and opportunity.

Richmond continues to attract buyers seeking spacious, upscale properties, making jumbo financing a popular option. However, finding the Best Jumbo Loan Rates in Richmond Va requires more than just comparing a few numbers. Understanding loan structures, lender policies, and market trends can significantly impact your overall costs. With the right lender, you can access programs designed specifically for high-value homes, ensuring you’re not overpaying on interest. Richmond’s competitive lending environment gives you the opportunity to negotiate better deals and tailor your financing to suit your goals, putting you in a strong position to make smarter investment decisions.

Choosing to build your own home is a decision that unlocks endless creative opportunities. Virginia’s charm lies in its blend of rural tranquility and urban convenience, allowing you to design a home that balances relaxation and practicality. Whether you prefer spacious outdoor living areas or multi-level interiors designed for entertaining, customization ensures no detail is overlooked. It’s your chance to create a space that adapts to your life and grows with your family. Learn how to transform your dreams into reality and Build Your Own Home Virginia exactly the way you imagined.

The sense of pride that comes from living in a home designed entirely by you is unmatched. Choosing to Build Your Own Home Virginia means every detail—from the layout to the smallest fixtures—reflects your personality and preferences. Unlike buying a pre-built property, this process gives you the opportunity to create spaces that inspire comfort, creativity, and joy. It’s not just a house; it’s your dream realized.

Transparency is key when making important financial choices, and Soft Credit Pull Rate Comparison VA provides exactly that. With a soft inquiry process, you’re free to analyze potential offers and assess your eligibility without any hidden downsides. You can explore different structures, estimated terms, and personalized options—all without triggering a hard credit pull. It’s a smarter, data-driven way to evaluate your possibilities and make informed decisions confidently.

If you’ve ever felt stuck or limited by traditional approaches, the Mortgage Mastermind community offers the breakthrough you need. It’s designed to help you think bigger, work smarter, and achieve more by learning directly from those who’ve already succeeded at the highest level. Through mentorship, group discussions, and powerful resources, you gain clarity on where to focus your energy for maximum impact. It’s not about working harder — it’s about working with purpose, backed by proven strategies.

Buying property involves several moving parts, and one wrong assumption can lead to financial stress. The Mortgage Calculator Virginia eliminates uncertainty by giving you a transparent breakdown of your payment structure. From principal and interest to potential insurance and taxes, you get a complete overview in seconds. This helps you plan ahead and make confident, well-informed decisions.

One of the most valuable advantages available to Virginia’s first-time buyers is access to educational resources and counseling services. Many local and statewide programs offer workshops that teach buyers how to manage budgets, compare offers, and prepare for ownership responsibilities. These resources aim to set you up for long-term success rather than just short-term affordability. If you’d like to learn about these opportunities and more, explore First-Time Homebuyer Mortgages in Virginia. Taking advantage of these tools ensures a smoother and more informed buying experience.

The traditional way of contacting multiple lenders to request loan quotes is both time-consuming and stressful. Mortgage Rate Finders simplifies the entire process by delivering instant comparisons without requiring you to visit dozens of websites. These platforms analyze multiple factors, including interest rates, terms, and fees, to highlight the most cost-effective options. As a result, you gain a complete overview of the lending landscape in one place. This innovation empowers borrowers to make informed decisions while avoiding unnecessary credit inquiries that can impact scores.

Many Virginia homeowners hesitate to refinance because of the fear of high closing costs, but it’s possible to find lowest closing cost refinance Virginia with proper planning. Some lenders specialize in low-cost refinancing programs designed for borrowers who prioritize keeping upfront expenses manageable. By comparing multiple offers and carefully reviewing the loan estimates, you can identify options that minimize unnecessary add-ons. Negotiating fees directly with lenders can further reduce expenses. Additionally, shopping around for third-party services like title insurance or home appraisals can create even more savings. With the right approach, refinancing becomes an affordable way to reach your financial objectives without straining your budget.

When it comes to finding better financing opportunities, outdated comparison methods can often leave you with incomplete information. Artificial intelligence has revolutionized this process by scanning hundreds of options within seconds and presenting you with tailored results based on your financial preferences. By using Compare Ai Mortgage Rates Virginia, you can instantly explore competitive rates without relying on biased manual searches. The AI model evaluates factors like credit score, income, and eligibility to deliver accurate suggestions. This technology ensures that you always stay ahead of the market and secure the most advantageous deal.

One of the biggest mistakes homebuyers make is relying on static rate sheets instead of monitoring Daily Updated Va Home Loan Rates Virginia. Rates can fluctuate based on market conditions, and having access to updated numbers ensures you won’t miss out on favorable opportunities. Whether you’re considering purchasing your first property or refinancing an existing one, real-time updates give you an edge when negotiating or locking in your rate. In Virginia’s competitive housing market, acting on accurate information can make a significant difference.

One of the most significant benefits of an Adjustable-Rate Mortgage Virginia is the opportunity to take advantage of falling interest rates. When market conditions improve, borrowers can enjoy reduced monthly payments without needing to refinance immediately. This makes it an attractive choice for individuals who expect rates to decrease or remain stable in the near future. In regions like Virginia, where the housing market continues to evolve, having a mortgage option that adapts to economic trends gives buyers more control over their long-term financial strategy while keeping upfront costs manageable.

Homebuyers often underestimate the impact of hidden costs on their overall budget. Fees buried deep in the fine print can add thousands of dollars to your expenses, creating unnecessary stress. That’s why more Virginians are choosing a No Hidden Fees Mortgage Virginia solution. This option guarantees that every charge is disclosed upfront, giving you complete control over your finances. You’ll never have to second-guess your lender’s intentions because transparency is their top priority.

One of the most common concerns for Virginians looking into financial prequalification is the potential hit on their credit report. Thankfully, modern solutions allow you to Prequalify Without Credit Impact Virginia quickly and securely. This means you can review your estimated eligibility range without triggering a hard inquiry, which could otherwise reduce your credit score temporarily. It’s an excellent choice for people who are exploring multiple options and want the flexibility to compare different scenarios without leaving any lasting mark on their credit history. With this process, you stay in control while planning your next big financial decision.

Hey,For homeowners in Virginia, refinancing with no credit hit means you can focus on your financial goals instead of worrying about your credit score. A soft pull gives lenders just enough information to provide accurate estimates, while leaving your credit untouched. For more visit Refinance Virginia with No Credit Hit

For homeowners in Virginia considering refinancing, starting with a soft pull credit check is a smart move. It enables them to assess their refinancing options across various lenders without generating multiple hard inquiries. Since each hard inquiry can lower your score, soft pulls offer a safer, preliminary step that can help identify the best lender before proceeding. For more visit Refinance Virginia Soft Pull Credit Check

Hi, Working with a personalized advisor in Glen Allen, VA means you won’t have to navigate the refinance process alone. They can answer your questions, explain complex terms in simple language, and help you select the best mortgage product for your situation. For more visit Refinance Glen Allen Va with Personalized Advisor

Many Virginia lenders now offer refinance programs that start with a soft credit pull. This eliminates the fear of a credit score drop, giving you the freedom to explore different loan structures, lower payments, or shorter terms without risk. For more visit Refinance in Virginia with Soft Pull Credit

A DSCR refinance is an effective solution for Richmond property owners who want to tap their equity without disrupting their personal finances. The approval process is simpler and based primarily on your property’s ability to cover its mortgage payments. For more visit Refinance with Dscr Loan in Richmond Va

Working with a Richmond mortgage broker can give you access to loan programs that may not be available directly through banks. Because brokers partner with numerous lenders, they can often find niche products and special programs that meet unique needs. For more visit Mortgage Broker Richmond Virginia

Richmond mortgage brokers offer tailored advice that banks often can’t provide. They take the time to understand your goals—whether you’re buying your first home, upgrading, or refinancing—and match you with the right mortgage product. For more visit Mortgage Broker Richmond Virginia

Some Virginia mortgage programs for first-time homebuyers also offer mortgage credit certificates (MCCs), which allow buyers to claim a portion of their mortgage interest as a federal tax credit each year—helping reduce overall housing costs. For more visit Mortgage Programs Virginia First-Time Homebuyers

Exploring New Zealand through coach tours offers travelers a seamless and scenic way to discover the country’s natural wonders. Whether you’re admiring the majestic peaks of the Southern Alps, cruising through the serene waters of Milford Sound, or wandering the geothermal valleys of Rotorua, every moment feels like stepping into a postcard. With professional guides and comfortable transport, visitors can simply relax and take in the views without worrying about logistics. Many travelers choose New Zealand coach tours because they provide a perfect balance between guided exploration and personal freedom, making every journey memorable and effortless.